Maxwell Ledger

Jun 23, 2024We Asked ChatGPT 4.0: Can Bitcoin Skyrocket to $1 Million? Here’s What It Had to Say!

Curious about Bitcoin’s potential to hit $1 million? We turned to ChatGPT 4.0 for answers, and the insights were both intriguing and enlightening. ChatGPT 4.0 dove into the complexities of economic indicators, market dynamics, and technological advancements to provide a detailed and engaging exploration of Bitcoin’s future. Join us as we unpack its predictions, supported by rigorous calculations and vivid visualizations, to see if Bitcoin can truly reach the $1 million milestone.

Interviewer: ChatGPT 4.0, can you tell us whether Bitcoin can reach $1 million by 2034?

ChatGPT 4.0: Predicting Bitcoin’s price in 2034 involves navigating a complex maze of economic indicators, market dynamics, technological advancements, and a bit of financial alchemy. Let’s dive into the factors that could influence Bitcoin’s price and examine some predictive scenarios.

The Current Landscape

Interviewer: What’s the current status of Bitcoin?

ChatGPT 4.0: As of June 19, 2024, Bitcoin is valued at around $65,000. Since its inception in 2009, Bitcoin has experienced dramatic highs and lows, driven by institutional adoption, technological innovation, and its appeal as a hedge against inflation.

Interviewer: Wow, $65,000! How did we get here?

ChatGPT 4.0: Bitcoin’s journey has been a rollercoaster. Early adopters saw exponential gains, and the introduction of Bitcoin futures, ETFs, and increasing institutional interest have all contributed to its growth. However, it’s also faced significant volatility, regulatory challenges, and market corrections along the way.

Predictive Models and Scenarios

Interviewer: Can you walk us through the different scenarios for Bitcoin’s future price?

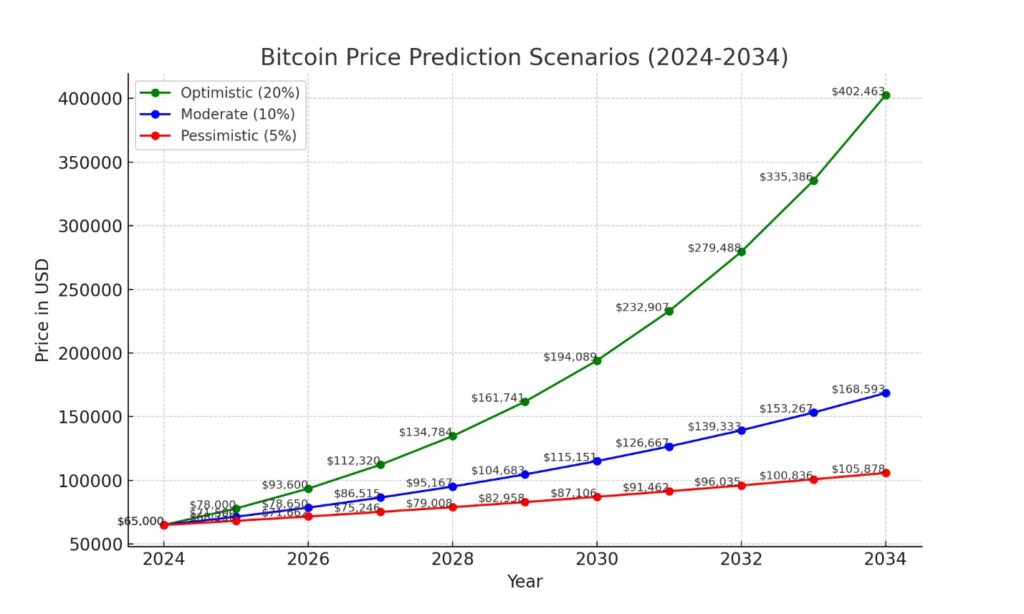

ChatGPT 4.0: Absolutely. Let’s consider three scenarios—optimistic, moderate, and pessimistic—to predict Bitcoin’s price in 2034.

Scenario 1: Optimistic Growth (20% Annual Growth)

Interviewer: What would an optimistic growth scenario look like?

ChatGPT 4.0: In this scenario, we assume Bitcoin’s price grows by 20% annually. Starting from $65,000, it would take about 15 years for Bitcoin to reach $1 million, meaning it could happen around the year 2039.

Interviewer: 20% per year sounds ambitious. What could drive such growth?

ChatGPT 4.0: Factors like widespread institutional adoption, global acceptance as a digital gold standard, and significant technological advancements that improve scalability and transaction speeds could contribute to such growth.

Scenario 2: Moderate Growth (10% Annual Growth)

Interviewer: And what about a moderate growth rate?

ChatGPT 4.0: With a 10% annual growth rate, Bitcoin’s price would take approximately 24 years to reach $1 million, placing the milestone around 2048.

Interviewer: 10% seems more realistic. What are the main drivers here?

ChatGPT 4.0: Steady growth in institutional adoption, gradual regulatory clarity, and incremental technological improvements would drive this moderate growth.

Scenario 3: Pessimistic Growth (5% Annual Growth)

Interviewer: Finally, what’s the outlook in a pessimistic scenario?

ChatGPT 4.0: Assuming a conservative growth rate of 5% per year, it would take about 50 years for Bitcoin to hit $1 million, meaning it might occur around the year 2074.

Interviewer: 50 years is a long time! What could slow Bitcoin down so much?

ChatGPT 4.0: Regulatory crackdowns, slow technological adoption, significant competition from other cryptocurrencies or digital currencies, and economic instability could all contribute to slower growth.

Visualizing the Predictions

Interviewer: Can you show us a visual representation of these predictions?

ChatGPT 4.0: Certainly! Here’s a chart illustrating the Bitcoin price prediction scenarios from 2024 to 2034 under these different growth rates:

Factors Limiting Bitcoin’s Ascent to $1 Million

Interviewer: What factors could limit Bitcoin from reaching $1 million?

ChatGPT 4.0: Several key factors could pose challenges:

- Market Cap Constraints:

- Current Market Cap: As of mid-2024, Bitcoin’s market capitalization is around $1.2 trillion.

- Market Cap at $1 Million: For Bitcoin to reach $1 million per coin, the market cap would need to be approximately $21 trillion, assuming all 21 million bitcoins are in circulation. This would exceed the market cap of all gold, which is about $11 trillion, representing a significant portion of the global economy. The feasibility of such a market cap is highly debatable.

- Regulatory Hurdles:

- Government Regulation: Governments around the world are still grappling with how to regulate Bitcoin. While some countries have embraced it, others have imposed stringent regulations or outright bans. Regulatory uncertainty can significantly impact Bitcoin’s adoption and price.

- Central Bank Digital Currencies (CBDCs): Many countries are developing their own digital currencies, which could compete with Bitcoin and limit its growth.

- Technological and Scalability Challenges:

- Scalability: Although solutions like the Lightning Network are being developed, Bitcoin still faces significant scalability challenges. High transaction fees and slower transaction times compared to other cryptocurrencies can hinder its widespread adoption as a daily-use currency.

- Security Risks: The increasing value of Bitcoin makes it a lucrative target for cyberattacks. Ensuring robust security while maintaining user accessibility is an ongoing challenge.

- Economic Factors:

- Global Economic Conditions: Economic stability and investor sentiment play crucial roles in Bitcoin’s price movement. During economic downturns, riskier assets like Bitcoin may see reduced demand.

- Inflation vs. Deflation: While Bitcoin is often touted as a hedge against inflation, it’s not immune to deflationary pressures and economic cycles. Changes in monetary policy and global economic conditions can affect its price.

- Market Sentiment and Speculation:

- Speculative Nature: A significant portion of Bitcoin’s price movement is driven by speculation. While this can lead to rapid price increases, it also makes Bitcoin highly volatile. Extreme volatility can deter long-term investors.

- Bubbles and Corrections: Bitcoin has experienced multiple speculative bubbles followed by corrections. Sustaining a $1 million price would require unprecedented and continuous demand, which is difficult given historical trends.

Why These Predictions?

- Optimistic Scenario: Driven by robust adoption, favorable regulations, and technological advancements, leading to substantial annual growth.

- Moderate Scenario: Reflects steady but slower growth due to mixed regulatory signals and gradual adoption.

- Pessimistic Scenario: Considers significant regulatory challenges, technological stagnation, and strong competition from alternative cryptocurrencies.

Michael Saylor vs. ChatGPT 4.0

Interviewer: But Michael Saylor assured us that it will reach $1 million very soon. So you do not believe him?

ChatGPT 4.0: Michael Saylor is a highly respected figure in the cryptocurrency space, and his confidence in Bitcoin reflects a deep belief in its potential. His prediction is based on rapid adoption, significant institutional investment, and favorable economic conditions. While his optimism is inspiring, it’s important to consider that predictions about future prices, especially for a volatile asset like Bitcoin, always carry a degree of uncertainty. I acknowledge his perspective, but it’s also crucial to weigh the potential risks and challenges that could impact Bitcoin’s growth. Balancing optimism with a comprehensive understanding of market dynamics and external factors is essential.

Comparing Bitcoin to Traditional Investments

Interviewer: How does Bitcoin compare to traditional investments?

ChatGPT 4.0: Here’s a detailed comparison:

Bitcoin vs. Stocks

Interviewer: Stocks have been a reliable investment for many. How does Bitcoin stack up?

ChatGPT 4.0: Bitcoin has provided substantial returns but with significant volatility. Stocks generally offer steady returns, averaging about 10% annually for the S&P 500. Bitcoin carries higher risk due to price volatility and regulatory uncertainty, whereas stocks are considered safer but still carry market-related risks.

Bitcoin vs. Gold

Interviewer: Many people consider gold a safe haven. Can Bitcoin replace gold?

ChatGPT 4.0: Bitcoin has outperformed gold in recent years in terms of returns but with higher volatility. Gold is a stable, low-risk investment ideal for hedging against economic uncertainty. Bitcoin carries higher risk due to price swings and technological issues, while gold remains a safe haven asset.

Bitcoin vs. Real Estate

Interviewer: Real estate is another popular investment. How does Bitcoin compare?

ChatGPT 4.0: Bitcoin offers potential for very high returns but is highly risky. Real estate provides steady returns and is seen as a good long-term investment. Bitcoin is volatile, while real estate involves liquidity issues but is lower risk.

Bitcoin vs. Bonds

Interviewer: Bonds are known for being safe. Is Bitcoin a good alternative?

ChatGPT 4.0: Bitcoin could yield high returns, but bonds offer lower, stable returns. Bitcoin’s high volatility contrasts with the low risk of bonds, which provide steady income through interest payments.

Summary

Interviewer: Can you summarize the key points for us?

ChatGPT 4.0: Certainly! Bitcoin offers high return potential but comes with significant risk due to its volatility and regulatory uncertainties. Stocks provide moderate to high returns with moderate risk. Gold is stable and low-risk, ideal for hedging against economic uncertainty. Real estate offers steady returns with some liquidity challenges, and bonds are the safest, offering low but stable returns.

A Debate: Will Bitcoin Reach $1 Million Soon?

Interviewer: Welcome to today’s debate! On one side, we have ChatGPT 4.0, our AI financial analyst. On the other side, we have Alex, a staunch believer that Bitcoin will reach $1 million very soon. Let’s dive in!

Interviewer: Alex, can you start by telling us why you believe Bitcoin will hit $1 million soon?

Alex: Absolutely! Bitcoin has shown incredible growth over the past decade. With increasing institutional adoption, limited supply, and its growing acceptance as a hedge against inflation, I believe we’re on the cusp of a major price surge.

ChatGPT 4.0: Those are valid points, Alex. However, while institutional adoption is growing, it’s important to remember that Bitcoin’s price is also influenced by significant volatility and regulatory uncertainty. These factors can create substantial barriers to reaching $1 million in the near term.

Alex: But ChatGPT, institutions like Tesla and MicroStrategy have invested billions in Bitcoin. Isn’t this a clear signal that Bitcoin’s value is on a strong upward trajectory?

ChatGPT 4.0: Institutional investment is indeed a positive sign. However, the market cap required for Bitcoin to reach $1 million per coin would be approximately $21 trillion, which exceeds the market cap of all gold. This level of market cap would require unprecedented and sustained global demand, which may take longer to materialize than a few years.

Interviewer: Alex, how do you respond to the concerns about regulatory hurdles?

Alex: Regulatory challenges are always a factor, but Bitcoin’s decentralized nature makes it resilient. Moreover, many countries are beginning to develop clearer regulatory frameworks, which I believe will ultimately benefit Bitcoin.

ChatGPT 4.0: It’s true that regulatory clarity can benefit Bitcoin. However, regulations can also limit its use or impose restrictions that could dampen investor enthusiasm. For example, stringent regulations in major markets like the US or the EU could significantly impact Bitcoin’s growth trajectory.

Alex: Let’s not forget technological advancements. Solutions like the Lightning Network are making Bitcoin transactions faster and cheaper. Doesn’t this solve some of the scalability issues you mentioned?

ChatGPT 4.0: Technological advancements like the Lightning Network are indeed promising and can enhance Bitcoin’s usability. However, widespread adoption of these technologies takes time, and there are still significant challenges related to security, user experience, and integration with existing financial systems.

Interviewer: One last question for both of you. What is the single biggest factor that could influence whether Bitcoin reaches $1 million soon?

Alex: For me, it’s institutional adoption. If more large-scale investors and corporations follow the lead of companies like Tesla, the demand could drive Bitcoin to $1 million much faster than expected.

ChatGPT 4.0: While institutional adoption is crucial, I believe the regulatory environment will be the biggest factor. Favorable regulations can boost confidence and investment, while adverse regulations could hinder Bitcoin’s growth and delay reaching the $1 million mark.

Interviewer: Thank you both for this insightful debate. It’s clear that while there is optimism about Bitcoin’s future, there are also significant challenges to consider. Stay tuned for more discussions on the fascinating world of cryptocurrencies!

Bitcoin vs. USD

Interviewer: Do you think Bitcoin will replace USD one day?

ChatGPT 4.0: While Bitcoin offers several advantages, such as decentralization and borderless transactions, replacing the USD entirely is highly unlikely. The US Dollar is deeply entrenched in the global economy, serving as the world’s primary reserve currency. Bitcoin faces significant challenges, including scalability issues, regulatory hurdles, and volatility, which make it difficult to function as a stable, everyday currency. However, Bitcoin could complement the USD and other fiat currencies, potentially playing a significant role in the financial system alongside traditional currencies.

Interviewer: What would it take for Bitcoin to replace the USD?

ChatGPT 4.0: For Bitcoin to replace the USD, several monumental shifts would need to occur:

1. Widespread Adoption

- Global Acceptance: Bitcoin would need to be accepted globally as a medium of exchange, unit of account, and store of value. This means businesses, governments, and individuals worldwide would need to trust and use Bitcoin for everyday transactions.

2. Regulatory Framework

- Supportive Regulations: Governments would need to create favorable regulations that encourage the use of Bitcoin while addressing concerns such as money laundering, fraud, and tax evasion.

- Legal Status: Bitcoin would need to gain legal recognition similar to traditional fiat currencies.

3. Technological Advancements

- Scalability: Significant improvements in Bitcoin’s scalability would be necessary to handle the transaction volume of a global currency. Technologies like the Lightning Network are steps in this direction but would need to be widely implemented and enhanced.

- Security: Continued advancements in blockchain security to prevent hacking and fraud would be essential.

4. Economic Stability

- Volatility Reduction: Bitcoin’s price volatility would need to decrease significantly to provide the stability required for daily transactions and long-term contracts. This could be achieved through broader adoption and increased market liquidity.

- Inflation Control: Unlike fiat currencies, Bitcoin has a fixed supply, which can prevent inflation but could also lead to deflationary pressures. A balance would need to be found.

5. Financial Infrastructure

- Payment Systems: Development of robust, user-friendly payment systems and infrastructure that can handle Bitcoin transactions efficiently.

- Integration with Financial Institutions: Banks and financial institutions would need to integrate Bitcoin into their services, including lending, savings, and investment products.

6. Public Trust and Education

- Trust: Building public trust in Bitcoin as a reliable and secure currency.

- Education: Widespread education efforts to ensure people understand how to use Bitcoin and its benefits and risks.

Interviewer: But many countries are ditching the USD right now. What do you think will replace it? Why not Bitcoin?

ChatGPT 4.0: It’s true that some countries are seeking alternatives to the USD for various reasons, including geopolitical considerations and a desire for more control over their own monetary policies. However, replacing the USD on a global scale is complex, and several factors come into play.

Potential Alternatives to the USD

Euro (EUR)

- Strengths: The Euro is already a major global currency and is widely used in international trade. The European Union has a large and stable economy, which adds credibility to the Euro.

- Challenges: Political and economic integration issues within the EU can create uncertainties.

Chinese Yuan (CNY)

- Strengths: China’s economy is the second-largest in the world, and the Chinese government has been pushing for the Yuan’s internationalization.

- Challenges: Lack of full capital account convertibility and concerns about government control and transparency.

Special Drawing Rights (SDR)

- Strengths: Issued by the International Monetary Fund (IMF), SDRs are a basket of major currencies and can provide stability.

- Challenges: Limited use in global trade and a complex system for adoption.

Central Bank Digital Currencies (CBDCs)

- Strengths: Many countries are developing their own digital currencies, which could offer a secure and efficient alternative to the USD.

- Challenges: Adoption and interoperability between different CBDCs remain significant hurdles.

Why Not Bitcoin?

ChatGPT 4.0: While Bitcoin has several attractive features, it faces significant challenges that make it unlikely to replace the USD as a global reserve currency in the near future:

- Volatility

Bitcoin’s price is highly volatile, which makes it less suitable as a stable medium of exchange and store of value.

- Scalability Issues

Despite advancements like the Lightning Network, Bitcoin’s scalability is still a concern. It currently cannot handle the transaction volume required for a global currency.

- Regulatory Uncertainty

Governments are still grappling with how to regulate Bitcoin. Regulatory uncertainty can hinder its widespread adoption.

- Adoption and Trust

While Bitcoin adoption is growing, it is not yet universally accepted. Building the level of trust and acceptance that the USD enjoys would take significant time and effort.

- Economic Structure

Bitcoin’s fixed supply could lead to deflationary pressures, which can be problematic for economies that rely on a certain level of inflation to stimulate growth.

ETH vs. Bitcoin

Interviewer: ChatGPT 4.0, can you tell us who will win and whether they can grow and coexist together?

ChatGPT 4.0: Absolutely! Let’s break down the strengths and differences between Ethereum and Bitcoin and explore whether they can coexist in the cryptocurrency ecosystem.

Comparing Ethereum and Bitcoin

Purpose and Functionality

Interviewer: What are the primary purposes of Ethereum and Bitcoin?

ChatGPT 4.0: Bitcoin was created as a decentralized digital currency, aiming to be an alternative to traditional fiat currencies and a store of value, often referred to as “digital gold.” Its main functions are peer-to-peer transactions and a hedge against inflation.

Ethereum, on the other hand, was designed as a decentralized platform for building and running smart contracts and decentralized applications (dApps). While it also serves as a digital currency (ETH), its primary focus is on providing a programmable blockchain for various applications beyond just currency.

Technology and Development

Interviewer: How do their technologies and development approaches differ?

ChatGPT 4.0: Bitcoin’s technology focuses on security and decentralization, with a conservative approach to changes. Its proof-of-work consensus mechanism ensures network security but faces scalability challenges.

Ethereum employs a more flexible and innovative approach. It’s transitioning from proof-of-work to proof-of-stake with Ethereum 2.0, aiming to improve scalability, security, and energy efficiency. Ethereum’s programmability allows for the creation of complex smart contracts and dApps, enabling decentralized finance (DeFi) and other blockchain-based services.

Market Position and Adoption

Interviewer: What about their market positions and adoption rates?

ChatGPT 4.0: Bitcoin, as the first cryptocurrency, enjoys a strong brand recognition and is seen as a store of value. It has a higher market cap and is widely accepted by institutional investors.

Ethereum, while having a lower market cap than Bitcoin, has seen tremendous growth due to its versatility. It dominates the DeFi space and supports a vast ecosystem of dApps, attracting developers and businesses to build on its platform.

Future Prospects and Coexistence

Interviewer: Given these differences, who do you think will win in the long run?

ChatGPT 4.0: It’s not necessarily a zero-sum game. Both Bitcoin and Ethereum have unique value propositions that appeal to different segments of the market. Bitcoin is likely to maintain its position as a store of value and a hedge against inflation, while Ethereum could continue to lead in the development of decentralized applications and smart contracts.

Can They Coexist?

Interviewer: So, can they grow and coexist together?

ChatGPT 4.0: Yes, Bitcoin and Ethereum can coexist and grow together. They serve different purposes and can complement each other within the broader cryptocurrency ecosystem. Bitcoin provides a stable store of value, while Ethereum offers a versatile platform for innovation in blockchain technology. Their coexistence can foster a more robust and diverse digital economy.

Interviewer: In summary, while Bitcoin and Ethereum have different strengths and serve different purposes, they both have significant roles to play in the future of digital finance. They can coexist and grow together, each contributing uniquely to the cryptocurrency ecosystem.

Alternatives to Bitcoin

Interviewer: ChatGPT 4.0, are there any alternatives to Bitcoin that are growing in popularity and could potentially rival it?

ChatGPT 4.0: Absolutely, there are several cryptocurrencies that have shown significant growth and popularity, each with unique features and potential. Here are some of the most notable alternatives to Bitcoin:

Ethereum (ETH)

Interviewer: Ethereum often comes up as a strong contender. Why is that?

ChatGPT 4.0: Ethereum is indeed one of the strongest alternatives to Bitcoin. While Bitcoin focuses on being a digital currency and store of value, Ethereum provides a platform for building decentralized applications (dApps) and smart contracts. This versatility has made it the backbone of decentralized finance (DeFi) and non-fungible tokens (NFTs). Ethereum’s transition to Ethereum 2.0, which includes moving from proof-of-work to proof-of-stake, aims to improve scalability, security, and energy efficiency, further boosting its appeal.

Binance Coin (BNB)

Interviewer: What about Binance Coin? It seems to be gaining traction.

ChatGPT 4.0: Binance Coin (BNB) is the native cryptocurrency of the Binance exchange, one of the largest cryptocurrency exchanges globally. BNB has gained popularity due to its utility within the Binance ecosystem, offering discounts on trading fees, participating in token sales on Binance Launchpad, and more. Additionally, Binance Smart Chain (BSC) has emerged as a significant player in the DeFi space, providing a cheaper and faster alternative to Ethereum, which has boosted BNB’s usage and value.

Cardano (ADA)

Interviewer: Cardano is another name that often comes up. What makes it stand out?

ChatGPT 4.0: Cardano (ADA) is known for its scientific approach to blockchain development. It emphasizes security, scalability, and sustainability, using a proof-of-stake consensus mechanism called Ouroboros. Cardano’s development is divided into distinct phases, each focusing on improving the network’s capabilities. The platform aims to provide a balanced and sustainable ecosystem for dApps and smart contracts, making it a strong competitor in the blockchain space.

Solana (SOL)

Interviewer: Solana has been in the news a lot lately. What’s driving its growth?

ChatGPT 4.0: Solana (SOL) has gained significant attention due to its high-performance blockchain, which offers fast transaction speeds and low costs. Solana’s architecture supports high throughput, making it an attractive platform for dApps, DeFi projects, and NFTs. Its ability to handle thousands of transactions per second (TPS) with minimal fees has positioned it as a viable alternative to Ethereum, especially for projects requiring high scalability.

Polkadot (DOT)

Interviewer: How does Polkadot compare to these other cryptocurrencies?

ChatGPT 4.0: Polkadot (DOT) is designed to enable different blockchains to interoperate seamlessly. Its unique multi-chain framework allows for the transfer of any type of data or asset across blockchains, enhancing interoperability. Polkadot’s ability to connect private and public chains, oracles, and future technologies makes it a highly flexible platform. This interoperability, combined with its robust governance model, positions Polkadot as a significant player in the crypto space.

Avalanche (AVAX)

Interviewer: Avalanche is another name we hear often. What’s its unique selling point?

ChatGPT 4.0: Avalanche (AVAX) is known for its high throughput and customizable blockchain solutions. It features a unique consensus mechanism that allows for sub-second transaction finality and supports thousands of transactions per second. Avalanche is designed to be scalable and interoperable, enabling the creation of custom blockchains and decentralized applications. Its speed and flexibility make it a compelling alternative to Bitcoin and other cryptocurrencies.

Interviewer: In summary, while Bitcoin remains the most well-known and widely adopted cryptocurrency, several alternatives are gaining traction due to their unique features and capabilities. Ethereum, Binance Coin, Cardano, Solana, Polkadot, and Avalanche each offer different advantages that appeal to various segments of the market. It’s an exciting time in the cryptocurrency space, with many options for investors and developers alike.

ChatGPT 4.0: Indeed, the cryptocurrency landscape is diverse and dynamic. Each of these alternatives to Bitcoin has the potential to grow and coexist, contributing to the overall development and adoption of blockchain technology.

ChatGPT 4.0 is Creating a New Cryptocurrency

Interviewer: If you could create a coin, what would it be and what qualities would it have?

ChatGPT 4.0: If I were to create a new cryptocurrency, I would design “ChatCoin” (CHT) with several key qualities that address current challenges and leverage emerging opportunities in the cryptocurrency space.

Key Qualities of ChatCoin (CHT)

1. Scalability and Speed

- High Throughput: ChatCoin would be designed to handle thousands of transactions per second (TPS) to support widespread use without congestion.

- Fast Confirmation: Transactions would be confirmed within seconds, ensuring quick and efficient transfers.

2. Security

- Robust Security: Utilizing advanced cryptographic techniques and decentralized consensus mechanisms to ensure the network’s security and integrity.

- Quantum-Resistant: Preparing for future threats by incorporating quantum-resistant algorithms to safeguard against potential quantum computing attacks.

3. Energy Efficiency

- Proof-of-Stake (PoS): Implementing a PoS consensus mechanism to significantly reduce the energy consumption compared to traditional Proof-of-Work (PoW) systems.

- Sustainable Practices: Encouraging environmentally friendly practices and rewarding nodes that utilize renewable energy sources.

4. Interoperability

- Cross-Chain Compatibility: Enabling seamless interaction with other blockchain networks, facilitating the transfer of assets and data across different platforms.

- Standard Protocols: Using standardized protocols to ensure compatibility with a wide range of decentralized applications (dApps) and services.

5. User-Friendly Experience

- Simple Interface: Providing an intuitive and user-friendly interface for wallets and transactions, making it accessible to both novice and experienced users.

- Education and Support: Offering comprehensive educational resources and support to help users understand and utilize ChatCoin effectively.

6. Privacy and Anonymity

- Optional Privacy Features: Allowing users to choose between transparent and private transactions, catering to different needs and regulatory environments.

- Enhanced Anonymity: Implementing privacy-focused technologies like zero-knowledge proofs to enhance transaction anonymity when desired.

7. Governance and Community Involvement

- Decentralized Governance: Establishing a decentralized autonomous organization (DAO) for governance, giving stakeholders a voice in the decision-making process.

- Community Incentives: Rewarding active community members who contribute to the network’s growth and development through participation and innovation.

8. Smart Contract Capabilities

- Versatile Platform: Supporting the creation and execution of smart contracts to enable a wide range of decentralized applications (dApps), from finance to gaming.

- Security Audits: Regularly conducting security audits of smart contracts to prevent vulnerabilities and ensure the integrity of applications built on the platform.

Potential Use Cases for ChatCoin

- Global Payments: Facilitating fast, low-cost, and secure cross-border payments.

- Decentralized Finance (DeFi): Enabling the creation of DeFi applications for lending, borrowing, and trading.

- Supply Chain Management: Providing transparency and traceability in supply chains, ensuring authenticity and reducing fraud.

- Digital Identity: Offering a secure and decentralized system for digital identity verification and management.

- Gaming and NFTs: Supporting the creation and trade of non-fungible tokens (NFTs) and in-game assets, enhancing the gaming experience.

Interviewer: ChatCoin sounds like a comprehensive and innovative cryptocurrency. What are the next steps to make this a reality?

ChatGPT 4.0: To bring ChatCoin to life, we would need to assemble a talented team of developers, cryptographers, and blockchain experts. We’d also engage with the community to gather feedback and ensure that the coin meets real-world needs. Securing funding through initial coin offerings (ICOs) or venture capital would be essential to support development and marketing efforts. Continuous iteration, testing, and improvement would ensure that ChatCoin remains at the forefront of innovation and adoption in the cryptocurrency space.

Interviewer: Thank you, ChatGPT 4.0, for this detailed vision of what a new cryptocurrency could look like. It’s exciting to think about the future possibilities in this ever-evolving field!

Conclusion

Interviewer: So, will Bitcoin reach $1 million?

ChatGPT 4.0: While the possibility of Bitcoin reaching $1 million is exciting, several factors make this scenario less likely. Market cap constraints, regulatory hurdles, technological issues, economic factors, and market sentiment all play crucial roles. The required annual growth rate of 48.12% over the next decade is exceptionally high and would necessitate unprecedented and sustained demand. However, Bitcoin’s journey remains an exciting rollercoaster ride, offering plenty of opportunities and challenges for investors.